Streamlined Loan Resolution Services

Revolutionizing Loan Settlements with Seamless Solutions for Effortless Debt Relief and Sustainable Recovery

Are you overwhelmed by debt?

Your Partner in

Financial Freedom

Struggling to make monthly payments? At BN Settlement, we understand the burden that debt can place on your life. Our mission is to provide you with a pathway to financial freedom through expert loan settlement services.

Why Choose Us?

Your Trusted Partner in Simplifying Loan Settlements and Securing Your Financial Future.

DEBT ASSESSMENT

We start with a comprehensive assessment of your financial situation, reviewing your debts, income, and expenses to create a clear picture of your financial health.

DEBT NEGOTIATION

Our skilled negotiators work directly with your creditors to lower the total amount of debt you owe. We aim to reduce your debt significantly, often by as much as 50% or more.

PAYMENT PLANS

Once a settlement is reached, we help you establish an affordable payment plan that fits your budget. Our goal is to make debt repayment as manageable as possible.

ONGOING SUPPORT

We provide ongoing support throughout the entire debt settlement process. Our team is here to answer your questions, address your concerns, and ensure you stay on track to financial freedom.

SUCCESS STORIES

Read about how we've helped clients like you overcome their debt challenges and achieve financial independence. Our success stories showcase the transformative impact of our services and the difference we can make in your life.

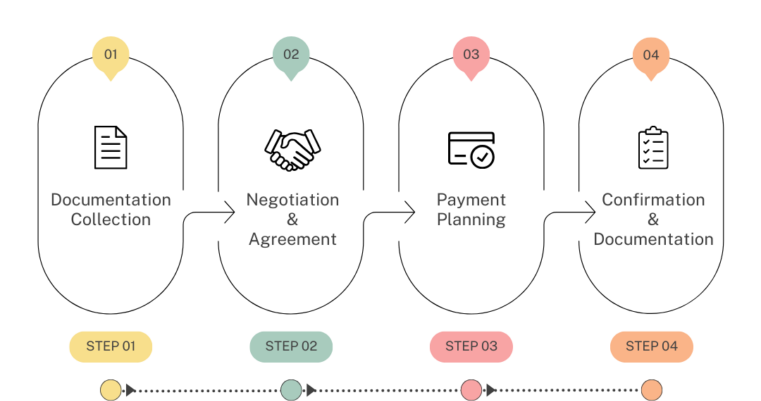

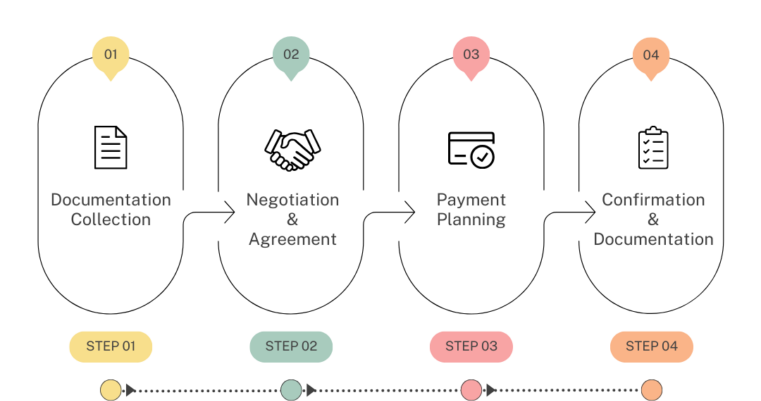

HOW IT WORKS

With 4 Easy Steps

YOU COULD BE NEXT IN LINE FOR SUCCESS

Happy Customers Speak

Quick and hassle-free process!

19 May 2024

From application to approval, the process was unbelievably fast. Plus, their customer support team was extremely helpful and guided me through every step. Highly recommended!

Sarah M.

Transparent and reliable

19 May 2024

They were transparent about all terms and conditions, and I appreciated the clear communication throughout the process. Got my loan without any hidden surprises. Thanks, team!

Michael

Excellent rates and options

19 May 2024

Compared to other loan platforms I've used in the past, this one offered the best rates by far.

Emily K.

YOUR BURNING QUESTIONS, EXPERTLY ANSWERED

Frequently Asked Questions

Debt settlement is a process where a debtor negotiates with creditors to reduce the total amount of debt owed, often resulting in substantial savings.

The length of the process varies depending on the amount of debt and the creditor. Typically, it can take 3 to 6 months to complete.

Debt settlement can impact your credit score, but many clients find that the long-term financial benefits outweigh the temporary decrease in credit.

If you are struggling to make payments and facing significant debt, debt settlement may be a viable option. Our experts can help you determine the best course of action for your situation.

LET US KNOW IF YOU'VE GOT ANY QUESTIONS

Contact Us